- The Idea Farm

- Posts

- Housel on Happiness

Housel on Happiness

+ Cliff Asness, Steve Romick, Gold & BTC, Michael Cembalest, Antti Ilmanen & More

Sponsored by

“When a speculator wins, he don’t stop till he loses.”

Research

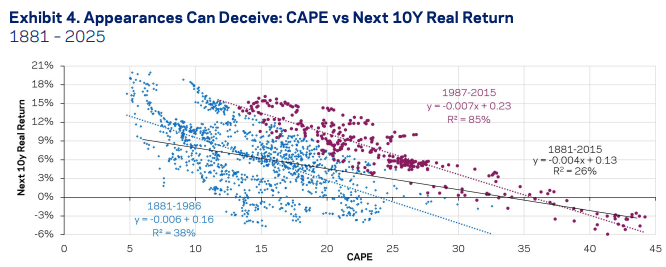

AQR analyzes valuation-based models for U.S. equity return forecasts, finding dividend yields and cyclically adjusted earnings yields most useful. The study shows growth forecasts often mislead—analysts’ 12.8% long-term EPS estimates far exceed the historical 2% real growth trend.

Man Group addresses five common myths about private credit, including the purported opposition between banks and non-bank lenders; the belief that private credit poses a systematic risk to the global financial system; and the claim that there is little differentiation between private credit lenders.

Vanguard addresses common misconceptions about index fund investing, emphasizing the potential benefits of diversification, low costs, and relative returns.

Deutsche Bank explores whether Bitcoin can join gold as a central bank reserve asset by 2030. Deutsche Bank also argues both assets could coexist as complementary hedges amid de-dollarization and geopolitical uncertainty.

J.P. Morgan’s Michael Cembalest explores AI’s outsized role in U.S. equity returns, government-backed chip investments, and China’s industrial oversupply. The report also highlights Chicago’s fiscal and crime challenges, and argues that tight net equity supply since 2011 has been a key driver of market resilience.

Bonus Content

David Nadig gave a presentation on the state of the ETF industry: Cheap, Fat, Starving for Attention. Link

The 2024 CCSF Study shares a closer look at long-term returns for foundations. Link

Barclays examined the impact of changes in the level of market concentration over the last 35 years given different scenarios. Link

Stifel shared an update on the biopharma market (77 slides). Link

UBS’ Paul Donovan says the kids are alright. Link

Caroline Crenshaw, an SEC Commissioner, gave a speech on private market risks. Link

"As calls for retail investor access to private markets accelerate, I am concerned that we are headed for a high-speed collision – with main street retail investors left without airbags."

Investing in Farmland: Real Assets. Real Returns.

For decades, institutional investors and the world’s wealthiest families have allocated a portion of their portfolios to U.S. farmland. And for good reason. Farmland is one of history’s most resilient and consistent-performing asset classes. It offers true diversification, stable cash flows, low volatility and steady capital appreciation.

Historically inaccessible for all but the world’s largest investors, AcreTrader now provides accredited investors with direct access to investment-grade farmland.

It’s time to diversify beyond the traditional. Protect and grow your principal with a real asset grounded in the bedrock of the global economy. Learn more about investing in farmland with AcreTrader.

Podcasts

Cliff Asness discusses electronic trading’s market impact, how AI is shaping investment approaches, and the current macro outlook with portfolio positioning. |

Steve Romick discusses risk management, value investing, and lessons from surviving the dot-com bubble while markets move faster than ever. |

Morgan Housel talks about money’s role in happiness, the pitfalls of comparing wealth, and why perception often outweighs reality in finance. |

What Else Is Happening

Did you miss last week’s email?